Britain’s consumers remain cautious about spending thanks to the instability of the country’s economy, making luxury goods something to be saved for special occasions for the majority of shoppers. Since the start of the recession, items such as expensive jewellery, designer clothing and electronics have failed to sell as well as expected – with, of course, a few exceptions such as the iPhone 5 and iPad.

However, elsewhere, it has been a different story. Thanks to the rapidly growing economies in areas such as China and the United Arab Emirates, exporting has become a stabilising factor for many British retailers, with an increasing number of designers choosing to focus on the Middle Eastern market as a means of ensuring their profits remain relatively stable as Europe attempts to get back on its feet.

Unfortunately, it appears that the Chinese market may no longer be so enamoured with expensive luxury goods, with Mulberry largely blaming a lack of interest in China for a profit warning and subsequent shares drop this week.

The company, which specialises in high quality leather handbags and has a large celebrity following, blamed a combination of low international sales and a 4 per cent decrease in wholesale shipping for the profit warning, which came as a huge shock to City forecasters expecting the firm to post hugely successful sales this year. Mulberry has now announced that sales for the year up to March will be lower than expected, and will even drop below the results from last year.

Another issue which must be factored in to the annual sales report, due in April 2013, is the decision to build a new factory in Somerset in order to keep up with consumer demand. The construction of the commercial property is expected to begin in the next few weeks, and will take a sizeable chunk out of the fashion label’s annual revenue.

A statement released by Mulberry said; “Primarily due to lower wholesale revenue, Mulberry now expects Group revenue growth for the year to 31st March 2013 to be below market expectations.

“As a result of this, combined with the previously highlighted investment being made in international retail expansion, we now expect full year profits to be below last year.”

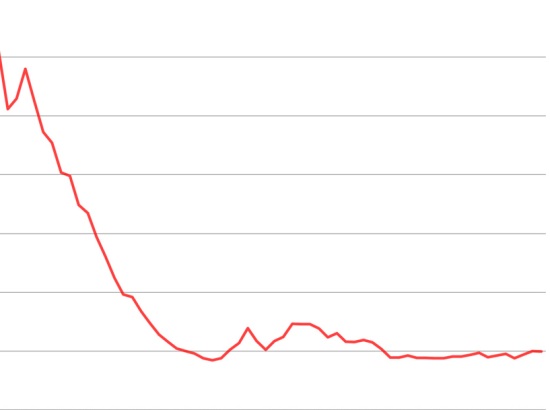

The profit warning caused an almost 30 per cent drop in morning trading on Tuesday this week, possibly due to the fact that this latest news was highly unexpected. Over the past year, Mulberry has upgraded its profit forecasts, with an announcement in June saying that the company had boosted full year profits by 54 per cent to £36 million.

Of course, Mulberry is by no means the first luxury brand to announce difficulties this year. In the first half, Aquascutum went into administration due to a lack of consumer demand, while Burberry recently released a profit warning – again, blamed upon a slowing of sales in the Chinese market.

Yet while this week’s profit warning seems to indicate a tough future for the firm, Mulberry has still managed to achieve a 13 per cent increase in UK sales when compared with the same time frame last year. Additionally, like for like revenue in the six months to September rose by 7 per cent, hinting that the label may not be in as dire straits as it seems to be.

Certainly, new chief executive Bruno Guillon, who joined the company from rival Hermes in March, seems positive about the future of Mulberry.

He said; “The Mulberry brand continues to gain recognition globally and we remain very confident in the outlook for the business.”

He continued to say that the short term slump in sales growth showed the need for the brand to improve its wholesale distributions network, but that Mulberry’s aim to build into a global luxury brand is well on track.

Do you think sales for companies specialising in luxury goods, such as Mulberry and Burberry, will improve as the UK pulls itself out of the recession, or will it take the resolution of the Eurozone crisis to truly save these iconic British brands? Would you splash out on a Mulberry handbag during a recession, or would you prefer to save money and opt for a cheaper high street alternative instead?

Previous Post

Gillian Clarke Pens Ode to John Lewis