China is still lagging behind Japan and Australia in commercial real estate investment. The two other countries currently have currently have the advantage of deeper inventory, more experienced investors and better transparency.

But according to Anthony Couse, a managing director for global real estate at Jones Lang LaSalle in Shanghai, this situation is about to change.

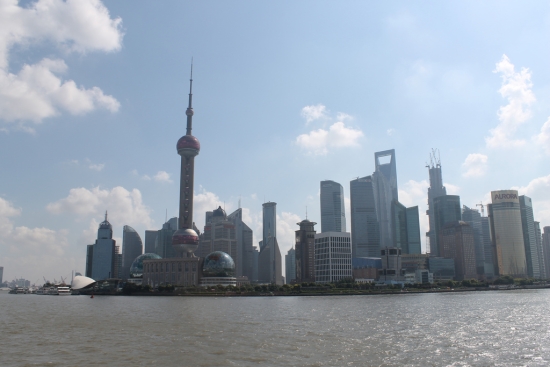

He stated recently that China’s commercial real estate market will surpass both countries over the next few years. As the economy shifts to a more service-driven one, and the supply of available properties rises, especially in major markets like Beijing, Shanghai and Guangzhou, China will be the new hot spot in the Asian market.

Couse isn’t the only one who is enthusiastic about prospects for investors over the next few years. The Blackstone Group is planning to raise up to $4 billion for a real estate fund that will be focused on China and Asia.

Over the last three years, investors have made money in Tier One cities and yields have compressed to between 4.7-5.2 per cent net, according to Couse.

He stated, “Growth has slowed. The Chinese government is talking about steady, slower growth, and China surely isn’t an attractive place anymore. It’s quite the opposite, actually. China is increasingly going to become a play for foreign investors.”

The three assets with the best potential for investors over the next three to five years will be retail, office, and logistics.

The emerging middle class will fuel the development of retail property. Beijing and Shanghai have several large malls which did not exist even a decade ago. There is potential for great returns in retail property, but Couse points out that it is the toughest asset class.

Demand is very high for office property in cities like Beijing and Shanghai. In 2011, there was 12 million square feet of office absorption. Beijing has a larger number of state-owned companies driving the Grade A sector and in Shanghai, insurance and finance companies are the major players.

Another category with great potential is logistics property. Investors are moving into the market and building modern warehouses to store goods of all types. The market is currently under supplied to respond to demand.