There are encouraging signs that property investors are slowly returning to the provincial markets. The latest figures show that between January and April there was a doubling of transactions across the UK accompanied by a rise in capital values.

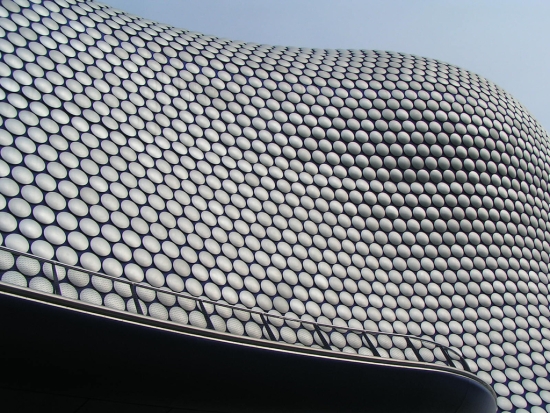

Investors are turning to major provincial centres like Birmingham

Since the onset of the economic downturn in 2007, London alone has ridden the storm relatively unscathed in comparison to the regions. This has continued to be the case in recent times despite the emergence of more encouraging economic indicators. But now, it appears, a combination of factors is turning attention away from the south-east.

Primarily this is explained by major property investors finding it difficult to achieve value for money in a market increasingly dominated by cash-rich overseas investors. The result of this is a growing focus on other locations.

At present it seems these locations are restricted to major provincial centres and it may be a while before the trend has a more widespread impact on flat markets, but the early signs are promising.

Generally, the feeling in the industry is that an upturn in provincial investment is underway and that tenant demand is improving across the range of commercial property categories. The perception that the economy is slowly recovering and that values are rising may well explain the upturn in commercial sales at the present time and further growth is dependent on the continuation of the fragile recovery.

While industry experts caution that it is too early to get carried away by the figures, it is clear from the number of stories emerging from the regions that there are attractive returns to be found outside the south-east for the first time in several years.

In this improving market the key to success for private investors, who account for the ownership of 12 per cent of UK commercial property, is spotting opportunities off the radar of institutional investors and major commercial companies.

The retail market, which has traditionally been the entry point for private investors, is still suffering as a result of a number of well documented factors, but in certain affluent locations it is still an attractive asset class.

The shortage of Grade A office supply may also provide opportunities to investors prepared to spend refurbishing older stock, while leisure and industrial property are also likely to offer attractive returns if the upswing continues.

Previous Post

UK Commercial Property Investment Expected to Rise