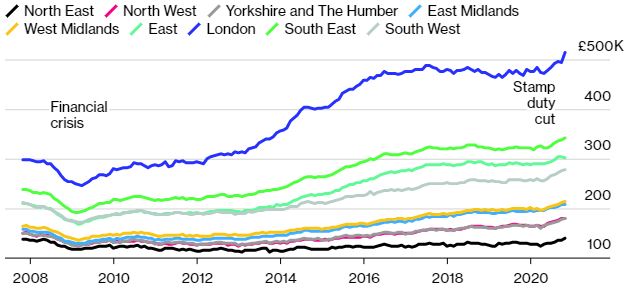

For the first time, the average house in the capital surpassed £500,000, bringing misery for first-time buyers in London and cheer to current homeowners.

London house prices are at an average of £513,997, which is more than double the UK (United Kingdom) level.

House prices in London were a massive 9.7% higher in November than the previous year, only matched by The Humber and Yorkshire, both found in northern England. The data was published on the 20 January 2021 by the Office for National Statistics.

Amid the coronavirus crisis, that has plunged the UK economy into its most profound decline in three centuries, the increase in prices will be unwelcome for young people. Already an issue for young people, the coronavirus crisis has widened the gap of being able to find a down payment on a home. Yet the older generations have only benefited from house values rising over the decades.

A graph showing the surge of London house prices compared to the rest of the UK.

Movehut has a large array of investment properties in London.

The rapid increase was part of several factors during the first national lockdown back in March 2020. The UK government issued tax cuts for homebuying worth up to as much as £15,000. The introduction of the stamp duty holiday which was issued in July, is expected to finish in March.

Boroughs in inner London, including Kensington and Chelsea – officially the UK’s most expensive district, recorded growth of 20%. Inner London house prices grew quicker than the outer boroughs. Interestingly, this growth was despite the increase of city homeowners moving to property with more green space in response to the coronavirus, and work patterns changing.

The ONS said, “Demand for property in inner London may be particularly responsive to temporary property tax changes as property prices are high and therefore, so is the corresponding tax to be paid.”

“In additional, compared with other regions of the UK, London has a relatively high proportion of properties bought for investment, including from cash buyers and overseas investors,” the ONS added.

The demand for property within the inner London Boroughs may continue to increase the ONS said. There are a number of nonresidents looking to snap up property ahead of a tax increase to be introduced in April.

We would like to know your thoughts on the rapid increase of house prices in London. Comment below.

Previous Post

Optimism from the Bank of England’s chief economist