Following a period of tough conditions in the commercial property market, Macdonald Estates Group has been forced to post a pre-tax profit of only £2.1 million for 2012. However, the firm has admitted that even this amount has been chalked up as a major achievement thanks to factors such as falling rents and a plunge in capital values.

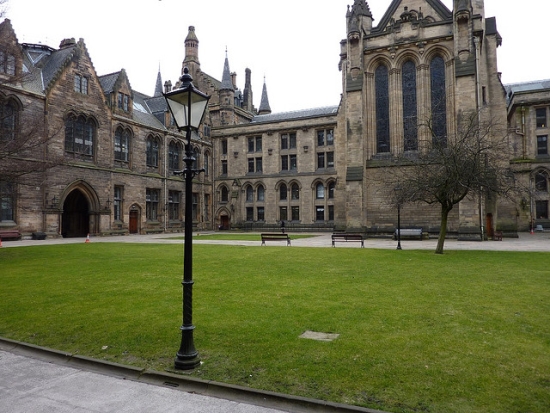

Macdonald Estates is looking towards students at the University of Glasgow

The firm also claimed that “greater expectations” from tenants further ate into its profit margin.

2012’s result highlights a worrying profit drop of almost 35 per cent from 2011, when the pre-tax profit recorded at Companies House totalled just under £3.2 million. This reflects the company’s drop in overall turnover which slid from £21.7 million in 2011 to just £14.2 million last year.

Macdonald Estates, which is based in Edinburgh, has now made the decision to continue with a diversification programme – this, in essence, will see the company dabble in markets outside its traditional target market within the retail sector.

Although development deals for supermarkets, including the letting of a store in Glasgow to Morrisons, and retail projects in Dundee and Gorebridge proved profitable during 2012, Macdonald Estates now believes that student accommodation projects are the way forward in terms of profitability.

The firm has already successfully created 75 student flats on Argyle Street in Glasgow in the past 12 months, and will begin work on a 230 unit development on Kelvinhaugh Street in April.

Sources at the firm have confirmed that the new project should be completed by August 2014, allowing Macdonald Estates to take advantage of a wave of students attending Glasgow’s three universities.

Dan Macdonald, group chief executive, admitted that the future could remain tough for commercial developers in Scotland, and as such branching out into other areas of the market may prove to be a wise move.

He said; “Retail development will continue to be our core business, but now that we have embarked on a programme of diversity we will seek other fields of opportunity including further new student accommodation projects throughout the UK.

“Commercial property development is now limited in its respect to generate great opportunity and it will remain so in Scotland for a number of years.

“We have to examine how we can achieve growth from refining the current portfolio and also embarking on new but allied areas within and strongly related to our core base of activity.”

Do you think recent signs of improvement in the market will quickly lead to new development opportunities in key areas like retail and offices or will the anticipated upturn take much longer to have an impact on development?

Previous Post

PIMCO Targeting Commercial Property Investments