As the referendum that will decide Scotland’s future draws closer, the debate over whether to go it alone as an independent state or remain within the UK is heating up.

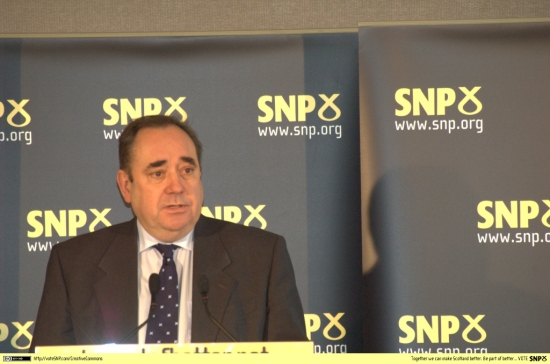

Politicians from both sides are using every opportunity to present their case. Yesterday both David Cameron and Alex Salmond were on separate visits to Aberdeen, but the Prime Minister refuses to meet the First Minister to publicly debate the issue.

Scotland’s business leaders, who will no doubt be happier when the uncertainty is over, have largely tried to stay out of the debate. However there are those who are prepared to be forthright.

Former chairman of Royal Bank of Scotland, Sir George Mathewson, is in the Yes camp. “Businesswise, I would like to see a tax regime that favours business and attracts business to Scotland,” he said last year. “I think independence would give people the feeling that opportunities exist.”

In the No camp is boss of Orion group, Alan Savage, who has threatened to move his company headquarters elsewhere if Scotland votes for independence. Unlike Sir George, Mr Savage believes that certainty on ‘business crucial areas’ is more likely if the country remains within the UK.

In terms of the commercial property market, there is anecdotal evidence that the continuing uncertainty is deterring some investors who are awaiting the result of September’s vote before deciding what their future strategies will be. But which outcome would be in the long term interest of the Scottish market?

Again, industry insiders are divided on the issue. Former Aberdeen Asset Management head, David Hunter, believes a Yes vote would have a ‘dramatic’ and ‘negative’ impact on Scottish commercial property values.

An independent Scotland would fall into the ‘overseas’ category for London based insurance and pension funds, he told The Scotsman.

“These managers will naturally wish to sell down their Scottish assets and with few obvious replacement buyers, investment values will plummet,” he warns.

Others have backed this point of view, displaying varying degrees of pessimism about the prospects for the Scottish market in the event of a Yes vote. In the worst case scenario they envisage a widescale flight from Scottish property which will no longer be regarded as an attractive asset.

On the other hand Dan Macdonald, the head of one of Scotland’s leading property developers, insists that the sector will ‘flourish’ in an independent state and that prime Scottish property would be a “very attractive investment.”

“The commercial property market and the Scottish economy can flourish post-2014. However this will only happen with a change of economic policy so that the focus is not only on London,” he said.

This is a view supported by a former leading member of RICS Scotland, Andy Lithgoe. “What counts is whether Scotland’s commercial property sector will benefit relative to a continuance of the status quo. Improved long term prospects are brought by independence,” he said.

Until the result of the referendum is known no-one can say for certain what the impact will be if Scotland votes Yes. Presumably there would be a period of further uncertainty while the terms of the separation were agreed and issues such as Scotland’s currency and EU membership were clarified.

In the meantime the situation may have given one or two investors the jitters, but it appears to be having no detrimental impact on the market. According to Cushman & Wakefield, there was an 81% increase in investment in Scottish commercial property during 2013, making it one of the best performing markets outside London.