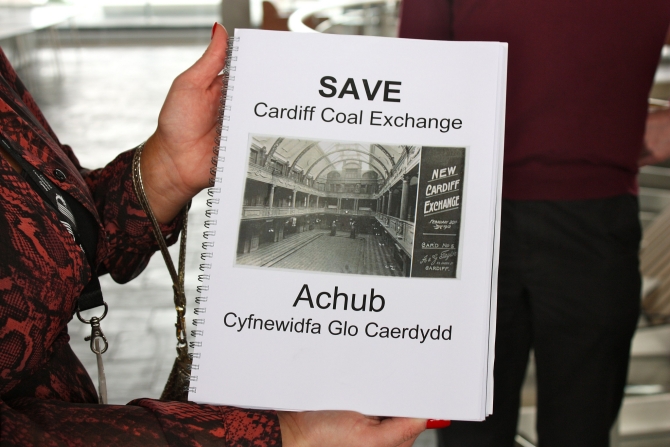

Plans to redevelop a historic Cardiff building have been met with opposition from conservationists. Under proposals currently being discussed, the Grade II listed Coal Exchange will be largely gutted in order to accommodate flats, offices and a hotel. But conservation groups argue that the scheme will rip the heart out of the building and are determined to prevent it being “degraded” in this way.

The Coal Exchange was designed by local architects James, Seward & Thomas and built between 1883 and 1886. For a long time it was the place where the price of coal was set and played a central role in the elevation of Cardiff to a thriving commercial centre. It is particularly notable for the fact that in 1901 the world’s first recorded £1m deal was struck on the floor of the Coal Exchange.

Trading ceased in the late 1950’s and, latterly, the building has been used as a concert hall. Among the acts to have graced its stage are American icon Patti Smith and Welsh giants the Manic Street Preachers. The venue closed last year due to safety concerns.

Among the building’s elaborate internal features are the wooden panelling, oak balcony and Corinthian columns of the trading hall. The commercial landmark also possesses fine stained glass windows.

Today the Coal Exchange is owned by property development firm Macob Exchange Ltd, whose plans for the future of the building are supported by Cardiff Council. The authority sees the proposals as an opportunity to regenerate the Mount Stuart Square area of the city which has been in decline for years.

The council also insists that the redevelopment is the best way to ensure the future of the building – some areas of which, they warn, are in “immediate danger of collapse.” Consequently the authority has been able to enact Section 78 of the Building Act (1984) giving it emergency powers to deal with a dangerous structure.

Campaigners against the plans argue that the council is exaggerating the state of the building in order to push through the redevelopment proposals without full scrutiny.

The Victorian Society believes that, rather than redevelopment, the building requires “sympathetic repair” and is urging the council to carry out a heritage assessment and to work with interested parties to “restore the Coal Exchange to its former glory.”

Now the petitions committee of the Welsh Assembly has called on the authority to clarify the proposals for the building and its use of Section 78.

In response the council has stated that, as a planning authority, it is obliged to consider any application from the property’s owners and that a “memorandum of understanding” is being drawn up with the developers to protect features such as the wooden panelling which the council describes as “sacrosanct.” A spokesman also reiterated the claim that the council is acting in the interests of public safety.

Previous Post

Lloyds Bank to sell European Commercial Property Loans