Irish property investment company Green REIT has confirmed it has conditionally agreed to buy an office building under construction in Cork city centre for up to €58m (£42m). Half the Albert Quay block has already been pre-let.

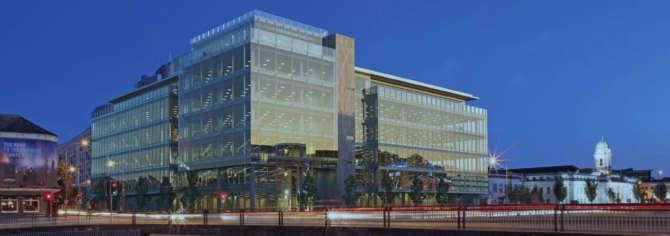

With an early 2016 completion date, One Albert Quay is being developed by the JCD Group which, under the guidance of chief executive John Cleary, has a reputation for attracting foreign direct investment into the Cork market. The seven-storey building will offer 166,000 sq ft of commercial space.

Two pre-letting agreements — claimed to produce €2.1m (£1.5m) in annual rent between them — have already been signed for just under 90,000 sq ft. Security and fire protection company, Tyco, is leasing 75,000 sq ft for its global headquarters and PricewaterhouseCoopers has agreed to take 14,000 sq ft.

In a statement the Dublin-based investment trust said the final sale price, between €55m and €58m would “depend on letting position at the final payment date … with phased payments to be made on lease commencement dates and the final payment 12 months after the initial payment” expected to be in the final quarter of 2017.

“We are delighted to announce the acquisition of what will be Cork’s best office building and the first major city centre office development in Cork for over a decade,” said Pat Gunne, chief executive of Green Property REIT Ventures.

“The yield premium over Dublin is attractive, particularly with the Cork office rental market at an earlier stage in the recovery cycle,” he added. “And we look forward to working with JCD Group in the period ahead to secure further high quality tenants for the remaining space in One Albert Quay.”

The JCD Group has also confirmed it is already in “detailed negotiations” with further potential occupiers for its Albert Quays development. “This deal is a huge vote of confidence in Cork and shows that investment firms view Grade A developments in the city as prime acquisitions,” said a spokesman.

“Cork has recently experienced a large take up in office space. JCD has leased over 360,000 sq ft of Grade A office space over the past two years,” he added. “This includes multinational technology companies such as EMC, Tyco, VCE, Qualcomm and SolarWinds, all of whom have subsequently increased their workforce creating hundreds of jobs.

“Our experience has shown that delivering new Grade A office space at up to 50 per cent of the cost of the greater Dublin area, combined with Cork’s highly educated talent pool, has made Cork a European destination of choice for many multinational companies.”

In a separate statement, Green REIT said it has enjoyed a “relatively stable” start to the year, “with the company well placed to perform strongly against the backdrop of a strengthening domestic economy and the continuing shortage of supply of quality office space in particular”.

Since 1 January, the investment trust had secured €1.12m (£814,000) of contracted rent with a further €0.7m (£508,000) of lettings under negotiation. The largest letting completed was of the second floor of Block G in Central Park in Leopardstown, where 26,000 sq ft was leased to Web Reservations International, an online travel booking company, in a 20-year deal.

Green REIT’s portfolio now contains 24 properties valued at €882m (£641m), producing a rental income of around €55m (£40m).

Previous Post

Highcroft scoops up Retail Park in Takeover Deal