PlaceFirst — a developer better known for regenerating empty houses — is dipping its toes into the commercial market with the conversion of a Victorian bath house to a business hub.

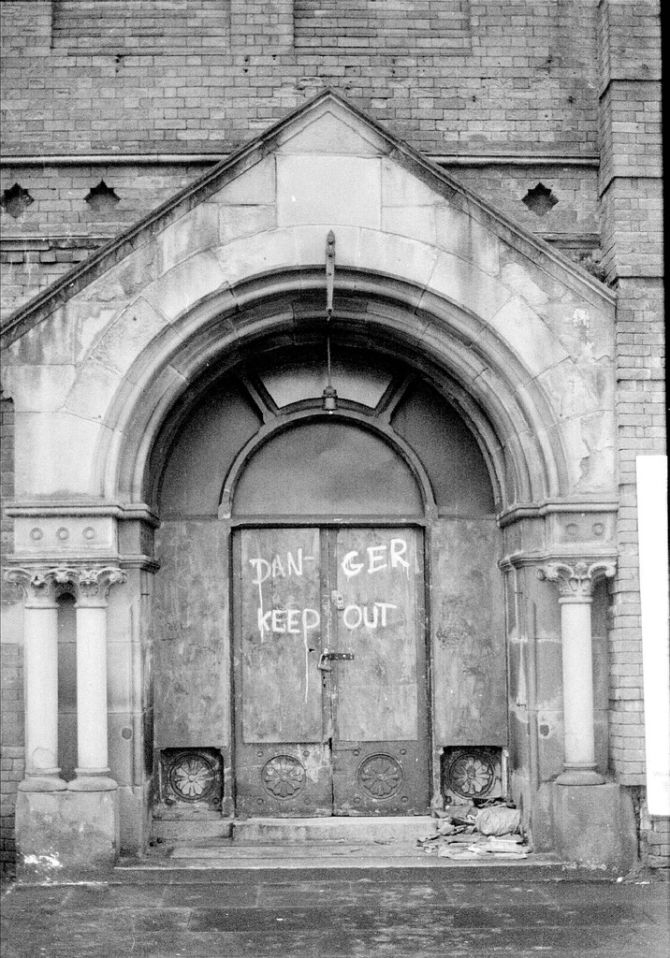

The Didsbury-based company acquired Ashton Old Baths, which have been empty for more than 40 years, from Manchester’s Ask Developments for an undisclosed sum. The red brick, Grade II listed building was one of the first public baths opened in Britain and is on English Heritage’s 2013 At Risk Register.

As part of the £3m scheme the main hall will be transformed into 6,460sq ft of flexible state-of-the-art business space. The developer has promised the interior “will be carefully designed to ensure the unique qualities of the main hall are preserved and enhanced”.

Modular units will be constructed inside the main hall, enabling the offices and meeting rooms to be heated efficiently without having to heat the entire vast space. And the main hall will be retained intact, rather than be divided into different levels, to enable people to see the elaborate roof structure. Several original rooms at the eastern end of the building will also be renovated and brought into use.

Funding for the flagship project — due to start in October, with completion next summer — is being shared between PlaceFirst, Tameside Council and the English Regional Development Fund which is donating £1m. The company is also working with the local authority on a Stage 2 Heritage Lottery Funding bid.

Confirming its involvement in the scheme, the council said: “The internal works will provide a balance between the historic and modern with sensitive restoration of the beauty and grandeur of the former pool hall, drawing comparisons to a cathedral, whilst providing private and modern secure pod accommodation for businesses that will also benefit from meeting space, cycle facilities, high speed internet and a café.”

When launched, the Ashton-under-Lyne hub will be run and operated by a charitable development trust managed by political and business leaders. Profits will be reinvested into the operation of the building to enhance and upgrade services for the tenants.

“Ashton Old Baths is such an iconic building we are thrilled to be working on such an exciting project,” said David Smith-Milne, managing director at PlaceFirst. “We are confident it will offer a unique working environment, providing the flexibility new businesses need and supported by some of the most powerful broadband connections in the country.”

Established in 2009, his company specialises in returning neglected residential properties to the market. It is currently transforming more than 300 empty homes across the North West into high quality, energy efficient housing for private rent.

Completed in 1870 at a cost of £16,000 Ashton’s Byzantine-style swimming baths has a 120ft high tower which once housed the flues from the steam boilers and heaters. When the baths were built, the pools did not have a water filtration system, and were refilled each Tuesday with water from the newly-opened Swineshaw Reservoir. Swimmers were charged sixpence on Tuesdays — with admission falling each day as the water got dirtier.

Previous Post

Edinburgh Historian searches for 200-Year-Old Wine Cellar beneath Condemned Office Block